How Adding a Zero to Your Bank Account Can Change Your Life

<?xml encoding=”UTF-8″>

How Adding a Zero to Your Bank Account Can Change Your Life

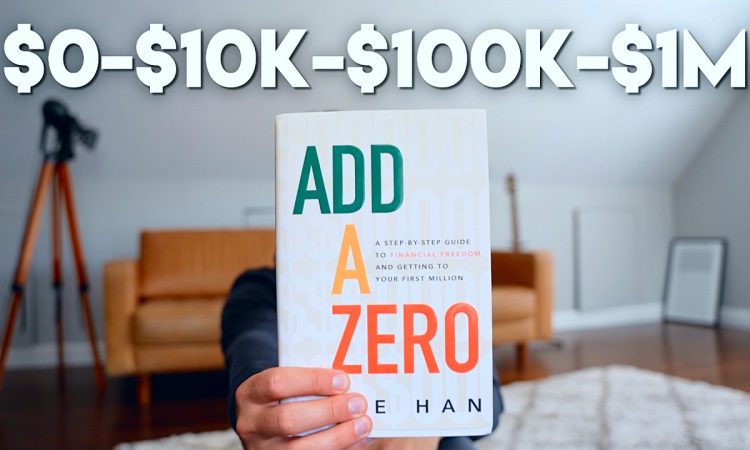

Picture this: adding a zero to your bank account becomes more than daydreaming. It’s a real-life game-changer. For many, it marks a huge leap towards financial freedom, bringing a sense of pride. That extra zero can quietly transform your life, easing stress and unlocking freedom. Recently, I stumbled upon a book that offers a roadmap to your first million. Let’s unpack some tidbits that might supercharge your journey to financial independence. You may also read: The Millionaire Mindset: How to Build Wealth and Achieve Financial Freedom

From Zero to Your First $10,000

Kicking things off, let’s talk about your first $10,000. It’s a biggie. This step teaches you to be disciplined. Achieving this might mean embracing frugal living—like swapping pricey lattes for homebrews. Personally, I took on side gigs like sprucing up office buildings to hit my first $10K. It’s no picnic, but it builds the groundwork for bigger financial leaps.

Being disciplined stops your cash from evaporating. If you don’t keep tabs on your money, even a pay bump won’t help. You gotta budget, track expenses, and practice holding off on splurges. Remember, this phase is temporary but key for building a strong base. It’s also a time to dive into finance education. Grasping basic money concepts, like compound interest, can hugely impact your money journey. Books, podcasts, and finance workshops are great companions here. I recommend you read: Building Wealth: The Truth About Income and Assets

Progressing to $100,000 and Beyond

With discipline under your belt, it’s system-building time. Rose, the book’s author, says, “Discipline builds the habit, but systems build wealth.” Shift your focus from pinching pennies to thinking big. Instead of saving a few bucks, ponder how to rake in thousands more. This mindset shift is crucial for reaching a million. Tap into your strengths and marketable skills. Can you freelance? Launch an online course? The digital world brims with ways to earn beyond a 9-to-5.

Many millionaires dive into businesses or real estate, strategies Rose and I have explored. Starting an online biz today can be a goldmine. Leverage is key, freeing you from trading time for money and helping you build income-generating assets. The gig economy and tech make it a breeze to turn passions into cash and reach a global audience. Use these tools to spread your income streams and bolster your financial future.

The Power of Leverage

Leverage is your secret sauce for maximizing time and money. Think rental properties or stocks for multiple income streams. Each investment, like a rental, can bring cash flow, value growth, and chip away at a mortgage, multiplying your money. The stock market, though a rollercoaster at times, has historically rewarded wise investors.

Building your own assets, like a YouTube channel, is another way to stretch your efforts. Each piece of content becomes a digital asset that can keep earning. Smartly leveraging your time and resources speeds up your financial freedom journey. Consider what special value you can offer and turn it into a lasting business model. Whether it’s digital products, affiliate marketing, or sponsored content, find ways to let your assets hustle for you. This will guide you in your journey: A Minimalist Approach to Personal Finance: How I Overcame My Debt

Reaching Your First Million

As you near $100,000, your financial snowball grows. Even modest returns can significantly boost your wealth, nudging you closer to that million-dollar mark. But remember, true financial freedom isn’t about hoarding stuff; it’s about owning your time. As Rose wisely puts it, “The real flex isn’t buying stuff, it’s owning your time.”

True wealth gives you the freedom to spend time with loved ones, support causes close to your heart, and chase passions without financial chains. The road to financial independence involves discipline, system-building, and leveraging resources. These steps lead to a life where you can ask, “Is this what I wanna do?” and have the freedom to choose. As you inch closer to your first million, ponder your broader financial goals. Planning for retirement, globe-trotting, or starting a charity? Let these dreams guide your investment moves and money plans.

Remember, financial freedom is a personal journey. What’s right for one might not suit another. Stay true to your values and make money choices that align with your long-term vision. This might mean short-term sacrifices for bigger future rewards. Don’t hesitate to seek advice from financial mentors who can offer guidance suited to your situation. However, be guided that, Banks Are Not in the Business of Making You Rich.

For more insights and a comprehensive guide on adding a zero to your bank account, consider diving into the book I mentioned. It’s brimming with strategies to fast-track your path to financial freedom. And if you’re curious about making money on YouTube, there’s a free 21-day course linked below. Whether it’s building a business or investing smartly, remember: the journey to a million starts with a single step.

Read More: The Bible’s Timeless Lessons on Minimalism and Wealth