Do This EVERY Time You Get Paid (Paycheck Routine)

<?xml encoding=”UTF-8″>

8 Clever Money Moves for When Payday Lands

It’s Friday, your wallet’s just been fed, and the siren call of new kicks, a swanky dinner, and the latest Hollywood blockbuster is hard to ignore. But before you blink, your paycheck’s vanished, and that pesky cycle of financial turbulence rears its head again. So, how do you keep your cash under control when it drops into your account? Let’s dive into eight savvy moves to make as soon as payday arrives, aiming for financial calm and some peace of mind.

Find Your Financial Footing

Before you sprint towards financial wizardry, you gotta know where you stand. It might feel like you’re grappling with a beast, which is why plenty folks dodge this task. But avoiding it leads to a classic trap called mental accounting, where money is categorized in the mind instead of on paper. Picture someone treating a tax refund as “free money” rather than overpaid tax coming back—it messes up the planning.

To dodge this, crack open a spreadsheet and jot down your monthly outgoings. Everything from rent to that extra cheese pizza. Knowing your financial footing—the bare minimum you need to keep ticking each month—gives you the reins. Try to keep this figure below half your paycheck, leaving room for that rainy day fund.

Stash Some Cash for Rainy Days

Picture the relief of having a stash big enough to ride out six months of expenses. An emergency fund isn’t just a nice-to-have, it’s essential. Life’s full of curveballs, and a financial buffer can help you tackle surprises with ease. Begin by squirreling away a slice of your income until you hit that six-month safety net. It’s a cushion that’ll soften life’s blows, letting you sleep a little easier.

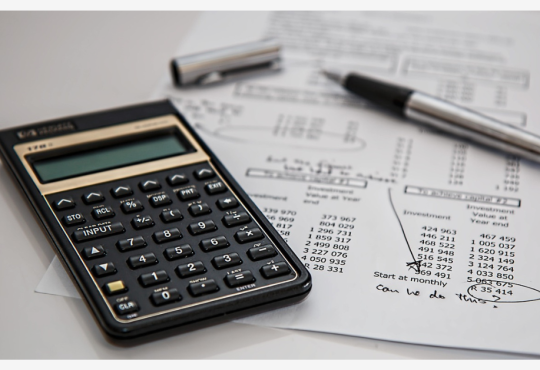

Kick High-Interest Debt to the Curb

Debt’s a heavy burden that looms over 77% of adults, and those high-interest types are the real troublemakers. Clearing these debts is key. It can save you a boatload in interest and fees. There are two paths here: the Avalanche or the Snowball. The Avalanche blasts away the highest interest loans first, saving you more in the long run. Meanwhile, the Snowball rolls over smaller debts, giving you a psychological lift as you knock them down. Pick what suits your style and stick with it.

Dip Your Toes in Investing

Investing might seem like a rollercoaster, but it doesn’t have to be scary. The magic lies in compound interest—Einstein called it the “eighth wonder of the world.” It lets your money grow like a snowball rolling downhill. Start with retirement accounts like a 401(k) or a Roth IRA. They come with tax perks and are a great starting point. If you’re curious about other options, look into taxable brokerage accounts with an eye on long-term growth. The sooner you start, the more time your dough has to multiply. Even modest amounts can blossom into something incredible over time.

Let Automation Do the Heavy Lifting

Automation’s a lifesaver in money matters. By setting up automatic transfers from your paycheck to savings, you avoid the mental gymnastics of manual money management. It keeps you on track, making sure savings and investments don’t slip through the cracks. Plus, auto-bill paying means no more late fees and a happier credit score. With this approach, you can focus on life’s finer things without sweating the small stuff.

Weigh Your Opportunity Costs

Time’s our most precious commodity, and weighing what’s worth your time is key. Consider if a side gig earns you more than hiring someone to tackle chores like cleaning. It lets you focus on what fits your skills and goals. Also, think about the opportunity costs of your spends. Every dollar splurged is a dollar not growing in an investment. Ponder the long-term effects of your choices, and you’ll make decisions that align with your financial compass.

Think Long-Term with Investments

Long-term investing is your ticket to financial stability. Unlike the short-term hustle of market timing, focusing on the big picture means less stress and more growth. Look into low-cost mutual funds or ETFs for diversity and lower risk. Stick to a steady investment schedule, no matter how the market’s behaving. This strategy, known as dollar-cost averaging, helps you ride out market waves and steadily build your nest egg.

Chase Financial Peace

Finally, financial peace isn’t just about numbers. Even if you’re nailing these steps, you might not always feel secure. It’s crucial to cheer yourself on and acknowledge your progress. Whether it’s wiping out a hefty debt, hitting a savings benchmark, or making your first investment, each step forward is proof of your grit and commitment. Celebrate the confidence that financial stability brings and let it enrich your life.

By weaving these strategies into your financial habits, you’ll make the most of your paycheck and pave the way to a stable financial future. The secret lies in consistency and making savvy choices that match your aspirations. As you trek along this financial path, keep your eyes on the freedom and possibilities that come with financial security. With every clever money move, you’re inching closer to the peace of mind you’ve been dreaming of.

Recommended Story: My Realistic Morning Routines as a Firts-Time Mom

[…] I made it, and I spent it. The money came in and out. Since nearly eight out of ten Americans live paycheck to paycheck, I’m guessing that’s something you can relate to as well. After four years of college, […]